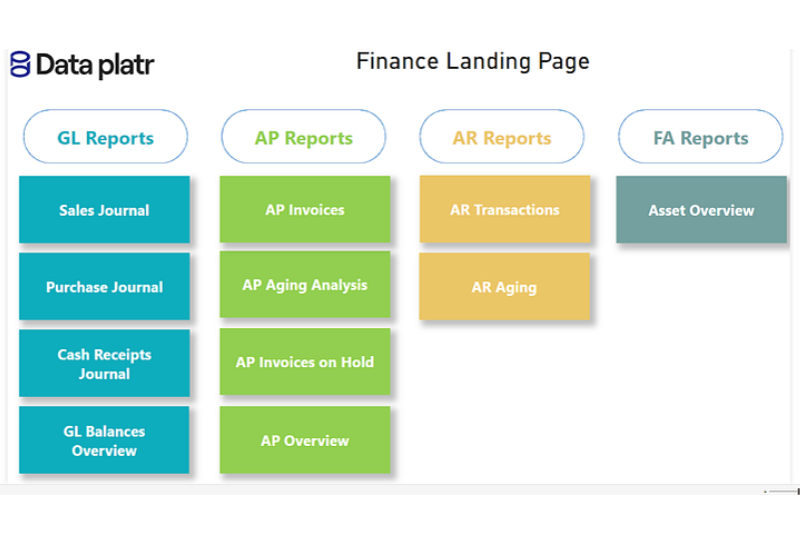

Financial Analytics: Unlock Accounts Receivable KPIs and Dashboard for actionable insights

Introduction

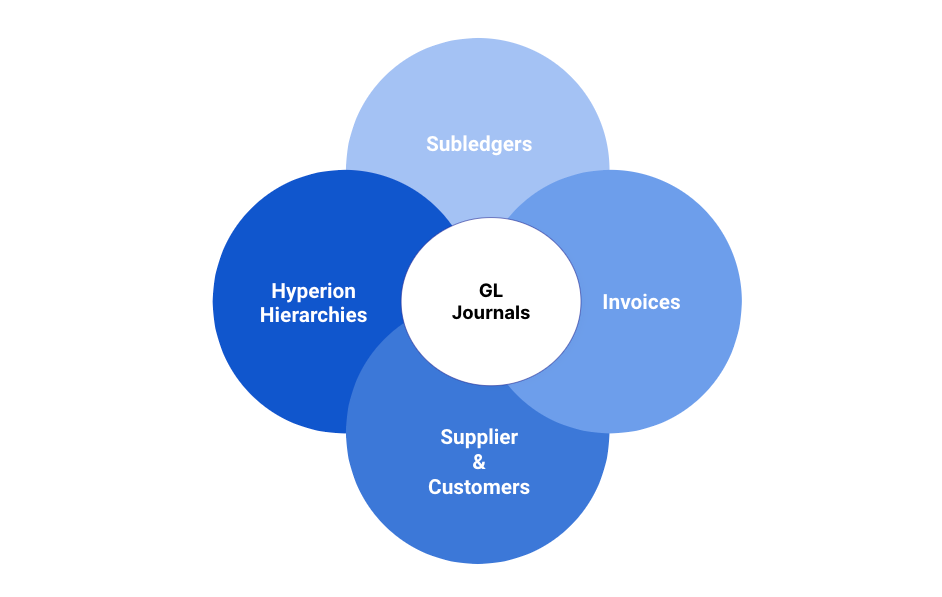

In today's data-driven landscape, leveraging financial analytics stands as a cornerstone for informed decision-making and strategic planning. As part of our initiative, we've implemented robust financial analytics on Google Cloud Platform (GCP), harnessing data from Oracle EBS (E-Business Suite) to empower businesses with actionable insights.

Understanding Financial Analytics

Financial analytics involves the systematic analysis of financial data to extract valuable insights, facilitate budgeting, facilitate forecasting, and drive informed decisions. This encompasses various methodologies, including descriptive, diagnostic, predictive, and prescriptive analytics, to understand past performance, uncover trends, mitigate risks, and optimize future strategies. In nutshell financial analytics is one stop shop to analyze the overall financial health of an organization.

What is Accounts Receivable?

Accounts Receivable (AR) refers to the outstanding invoices raised on customers for goods or services provided on credit. From a financial analytics perspective, AR data is used to track due and balance amounts, analyze aging trends, monitor receipts, and measure collection efficiency using accounts receivable KPIs and dashboards. This enables stakeholders to gain actionable insights into cash flow, overdue invoices, and overall receivables performance.

Deep Dive into Accounts Receivable KPIs Dashboard

Accounts Receivable Module and its Topics

In this articles we will be covering 2 topics under Accounts Payable Module

- Transactions ( Dashboards & KPIs )

- Receipts ( Dashboards & KPIs )

1.1 Transaction Dashboards

1.1.1 AR Transaction Summary Dashboard

The AR Transaction Summary Dashboard offers a comprehensive view of the end-to-end lifecycle of accounts receivables, providing detailed insights into AR transactions, due/balance amounts, invoices, journals, and customer-level information. This dynamic dashboard serves as a powerful tool for financial analysis and decision-making, enabling stakeholders to monitor and manage AR processes effectively

1.1.2 AR Aging Analysis Dashboard

The AR Aging Analysis Dashboard provides a comprehensive overview of accounts receivable invoices that are due for payment. This dynamic accounts receivable kpi dashboard aids in tracking open invoices by their invoice and payment schedule dates, offering valuable insights into aging trends and payment timelines as part of accounts receivable reporting.

1.1.3 Tax Invoice Reconciliation Dashboard

The Tax Invoice Reconciliation Dashboard provides a platform for analyzing Accounts Receivable (AR) invoices and their associated tax amounts. This dashboard streamlines the reconciliation process, offering insights into tax-related data and facilitating accurate financial reporting using accounts receivable analytics

1.2 Transaction KPIs -

Invoice Amount

Invoice amount is one of the key accounts receivable KPIs that helps in tracking the total amount against the invoices that were processed in a given period.

Credit Memos Amount

This amount is one of the key KPI that helps in tracking the total amount against the credit memos that were processed in a given period.

Debit Memos Amount

This amount is one of the key KPI that helps in tracking the total amount against the debit memos that were processed in a given period.

Transaction Amount

Transaction amount shows the sum of invoice amount, debit memos amount and credit memos amount.

Invoice Count

Invoice count helps in tracking the number of AR invoices that were processed in a given period.

Credit Memos Count

Credit memos count helps in tracking the number of credit memos that were processed in a given period.

Debit Memos Count

Debit memos count helps in tracking the number of debit memos that were processed in a given period.

Customer Count:

This KPI helps in getting the distinct count of customers to whom the AR invoices are raised in a given period.

Balance Amount:

This KPI gives the outstanding AR amount as of a given period. Monthly snapshots are taken to derive the outstanding amount as of each month so that month on month analysis can be enabled to see if the outstanding AR is going up or down.

AR Aging by Invoice Date:

This KPI shows the aging amount for the open invoices based on invoice date grouped by selected period.

AR Aging by Schedule Date:

This KPI shows the aging amount for the open invoices based on payment schedule date in oracle EBS grouped by selected period.

Open Invoices Count:

This KPI gives the total count of invoices that are yet to be paid by the customers as of a given period using accounts receivable key performance indicators.

2.1 Receipt Dashboards -

2.1.1 Cash Receipts Dashboard

The Cash Receipt Dashboard offers a comprehensive view of Accounts Receivable (AR) receipts, providing detailed insights into payments received against AR transactions. This dynamic accounts receivable dashboard serves as a central hub for monitoring cash inflows, enhancing transparency, and facilitating effective cash management through accounts receivable KPIs.

2.2 Receipt KPIs -

Receipts Amount

Receipts or payment amount reflects the total payment received from a customer against the AR invoices in a given period. This KPI is one of the vital accounts receivable KPIs to understand the overall invoice payment recovery efficiency.

Receipt Count

Receipt count gives the number of payments that were processed in a given period. This as well is an indicator to measure the overall invoice payment recovery efficiency.

Early Receipt :

This KPI gives the count of the AR invoice payments that were done before their due dates under accounts receivable KPIs.

Ontime Receipt :

This KPI gives the count of the AR invoice payments that were done as per their due dates. This along with early payment KPI helps in tracking the customer who repays on or before the payment scheduled.

Late Receipt:

This KPI gives the count of the AR invoice payments that were done after their due dates. This will help in tracking the defaulter which means the customers who are not paying on time through accounts receivable KPIs.

Conclusion:

Each of these metrics provides critical insights into the performance and efficiency of the accounts receivable processes. Analyzing these metrics helps in making data-driven decisions, optimizing payment performance, analyzing outstanding and overdue invoices, analyzing credit and debit memos. The report assists managers and stakeholders in understanding the overall health and effectiveness of the accounts receivable operations.

How Data platr can help?

Data platr specializes in delivering cutting-edge solutions in the realm of financial Analytics with a focus on leveraging the power of Google Cloud Platform (GCP) / Snowflake / AWS. Through our expertise, we provide comprehensive analytics solutions tailored to optimize accounts receivable operations. By harnessing the capabilities of Cloud, we offer a robust framework for implementing advanced analytics tools, allowing businesses to gain actionable insights and make data driven decisions.

Curious And Would Like To Hear More About This Article?

Contact us at [email protected] or Book time with me to organize a 100%-free, no-obligation call