What is Accounts Payable Analytics?

Accounts payable analytics is the systematic process of collecting, measuring, and interpreting data from your organization's AP operations to improve financial decision-making and process efficiency. It transforms raw transaction data into actionable insights that help finance teams understand spending patterns, identify bottlenecks, and optimize payment operations.

At its foundation, accounts payable analytics examines every touchpoint in the invoice-to-payment cycle. This includes when invoices arrive, how long they sit in approval queues, payment timing, vendor relationships, and exception handling. By analyzing these data points, organizations gain visibility into aspects of their AP function that often remain hidden in day-to-day operations.

What is Accounts Payable Analytics Accelerator?

An accounts payable analytics accelerator is a pre-built framework that organizations use to rapidly implement data analysis capabilities within their AP operations. Think of it as a starter kit that comes with ready-made data models, dashboards, and reporting templates specifically designed for accounts payable processes.

Unlike building an analytics solution from scratch, which can take months of development time, an accelerator provides the foundational architecture and common metrics that most finance teams need. This means your organization can start extracting insights from AP data in weeks rather than months.

10 Benefits of Accounts Payable (AP) Automation

Automating accounts payable processes represents one of the most impactful digital transformations finance departments can undertake. Organizations that transition from manual workflows to automated systems experience measurable improvements across efficiency, cost management, and strategic capabilities.

- Dramatic Reduction in Processing Costs - Manual invoice processing carries significant hidden costs, including labor hours, postage, printing, and physical storage. The cost per invoice typically ranges from $12 to $30 in traditional environments. AP automation reduces these costs by 60% to 80% by eliminating data entry, physical document handling, and storage expenses while allowing teams to focus on higher-value activities.

- Faster Invoice Processing Cycles - Paper invoices move slowly through organizations, with average manual processing cycles taking 15 to 30 days from receipt to payment. Automated systems compress this timeline to 3 to 5 days through electronic capture, parallel approval routing, and instant matching. Mobile approval capabilities eliminate waiting periods, directly improving your ability to capture early payment discounts.

- Improved Early Payment Discount Capture - Many vendors offer 2% discounts for payment within 10 days, yet manual processes often miss these opportunities due to slow processing. Automation enables systematic discount capture by meeting tight deadlines consistently. An organization spending $50 million annually that captures half of the available 2% discounts saves $500,000 yearly.

- Enhanced Accuracy and Reduced Errors - Manual data entry generates error rates between 1% and 3%, creating downstream problems with incorrect payments and vendor disputes. Automated data capture achieves accuracy rates above 95%, approaching 99% with validation rules. Three-way matching and duplicate detection prevent common errors that cost organizations time and money.

- Greater Visibility and Control - Manual AP processes operate as black boxes, where tracking invoice status requires phone calls and email inquiries. Automated systems provide complete transparency through centralized dashboards showing exactly where each invoice sits in the workflow. This visibility extends to cash flow forecasting and automatic audit trails that document every action without manual effort.

- Strengthened Fraud Prevention - AP fraud costs organizations billions annually through duplicate payments, fictitious vendors, and invoice manipulation. Automated systems incorporate vendor master file controls, approval hierarchies, and duplicate detection algorithms. Analytics capabilities flag unusual patterns like sequential invoice numbers from different suppliers, making fraud harder to execute and easier to detect.

- Better Compliance and Audit Readiness - Regulatory requirements demand detailed documentation of AP activities, while manual systems struggle to maintain complete audit trails. Automated systems create comprehensive digital records with timestamps, user identities, and action histories. When auditors request information, you can retrieve relevant documents and reports within minutes rather than days.

- Improved Vendor Relationships - Manual processing creates friction through payment delays, lost invoices, and unclear status updates that frustrate suppliers. Automation delivers predictable, timely payments and self-service portals where vendors can check invoice status independently. When you automate your accounts payable function, vendors view your organization as professional and reliable, potentially leading to better pricing and preferential treatment.

- Scalability Without Proportional Cost Increases - Manual AP departments must add staff as transaction volumes grow, with headcount scaling nearly linearly with invoice volume. Automated systems handle increased volumes without proportional cost increases. The same platform and team managing 5,000 invoices can often handle 15,000 or 20,000 with minimal additional resources.

- Strategic Decision-Making Through Analytics - Manual processes generate limited insights beyond basic reporting, leaving finance teams without visibility to optimize working capital or negotiate better terms. Modern AP automation platforms transform transaction data into strategic insights through accounts payable dashboard displays of key accounts payable KPIs. These analytics enable financial process automation strategies that drive continuous improvement and contribute directly to organizational profitability.

Dataplatr Accounts Payable (AP) Accelerator

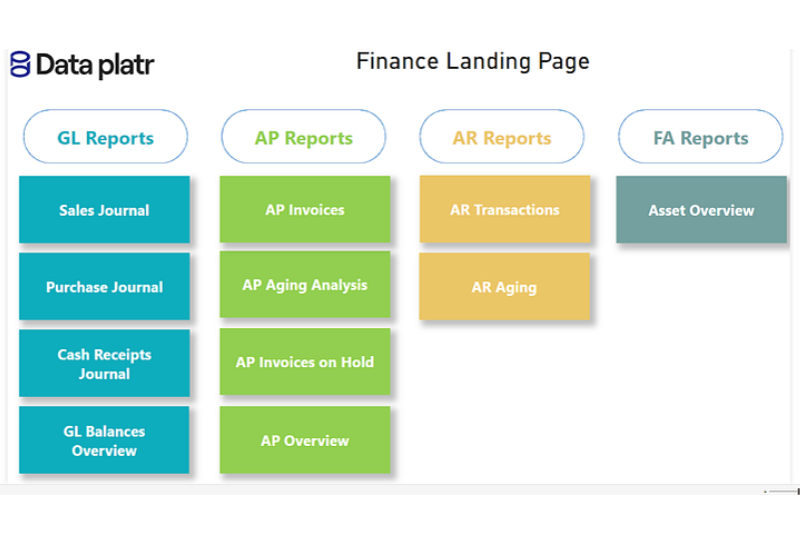

Organizations running Oracle EBS, Oracle Fusion, SAP, or NetSuite struggle to extract meaningful insights from AP data due to fragmented systems and labor-intensive reporting processes. The Dataplatr Accounts Payable Analytics Accelerator transforms raw AP data into actionable intelligence through automated pipelines built on medallion data architecture, eliminating months of custom development while providing real-time visibility into payment trends and optimization opportunities.

The accelerator delivers pre-configured accounts payable dashboard templates that monitor critical accounts payable KPIs, including payment cycles, processing bottlenecks, and vendor performance patterns. By reducing manual effort by up to 70% and providing audit-ready outputs, the solution empowers finance teams to optimize working capital, capture early payment discounts, and transform AP operations from transactional processing into strategic value creation.

Business Challenge: The Accounts Payable Analytics Gap

Most enterprises lack comprehensive accounts payable analytics capabilities to manage complex AP operations effectively, resulting in costly inefficiencies and limited strategic visibility.

- Disconnected Payment Systems: Multiple payment platforms create data silos across Oracle EBS AP runs, Oracle Payments/IBY, and bank portals that fragment AP analytics efforts. Multi-org operating units with inconsistent supplier IDs and bank accounts make unified visibility impossible, leading to duplicate payments and inaccurate cash positioning. Without consolidated accounts payable analytics, organizations cannot achieve enterprise-wide payment transparency.

- Manual Reconciliation Processes: Finance teams spend excessive time on two-way and three-way matching across purchase orders, receipts, and invoices without automated analytics support. Price variances, tax differences, prepayment applications, and unmatched receipts require constant manual intervention that delays period close. Proper accounts payable analytics infrastructure would flag these issues automatically and reduce reconciliation time significantly.

- Limited Cash Flow Visibility: Organizations lack the AP analytics foundation needed to forecast payment obligations due to scattered schedules, complex discount terms, and installment invoices. Payment runs in-flight and invoices stuck in approval or hold states remain invisible in cash projections. This analytics blind spot prevents treasury teams from optimizing working capital effectively.

- Vendor Relationship Gaps: Insufficient accounts payable analytics capabilities limit insights into supplier performance metrics, including on-time payment rates and discount capture percentages. Master data quality issues and limited visibility into chargebacks, credit memos, and aging balances prevent effective vendor management. Without robust AP analytics, organizations miss early payment opportunities and lack data for stronger supplier negotiations.

Dataplatr Accounts Payable Analytics Solution

The Dataplatr Accounts Payable Analytics Accelerator transforms operational challenges into competitive advantages by delivering comprehensive analytical capabilities purpose-built for enterprise AP environments.

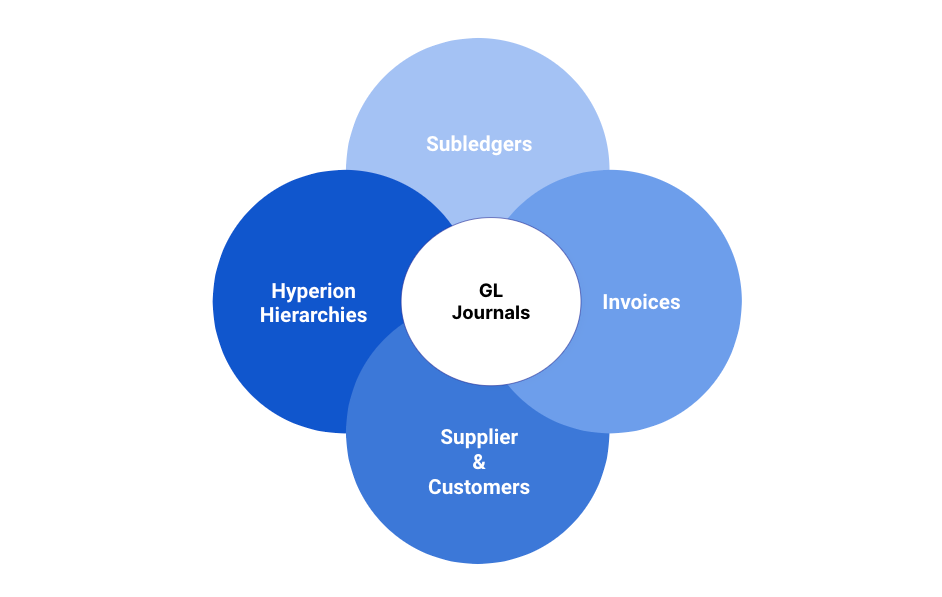

- Unified Payment Analytics: Consolidates invoice, supplier, and payment data across Oracle EBS AP, Oracle Payments, and bank systems into a single accounts payable analytics model. This delivers enterprise-wide visibility into liabilities, payment runs, and settlement trends across multiple operating units and ledgers, eliminating data silos that prevent strategic decision-making.

- Automated Invoice Processing Analytics: Tracks invoices from receipt to final payment while highlighting delays in matching, holds, or approvals through advanced AP analytics. Exception dashboards drill into root causes, including pricing mismatches, missing receipts, and tax variances, to reduce cycle time and eliminate manual reconciliations.

- Predictive Cash Flow Management: Integrates payment schedules, terms, discounts, and approval status with historical trends through machine learning-powered accounts payable analytics. These predictive models project future cash outflows, discount capture opportunities, and liquidity requirements, giving finance leaders actionable visibility into working capital optimization.

- Vendor Performance Intelligence: Measures supplier reliability through accounts payable analytics that track invoice disputes, on-time payments, credit memo utilization, and discount capture rates. Data-driven supplier scorecards improve negotiations, foster stronger partnerships, and align procurement objectives with AP execution through strategic analytics insights.

- Audit-Ready Compliance: Provides a complete lineage of invoices, approvals, payments, and accounting entries through a comprehensive accounts payable analytics infrastructure. Automates regulatory reporting, including 1099, VAT, WHT, and TDS, while enforcing segregation-of-duties monitoring, ensuring compliance through standardized dashboards and exportable audit packs.

Medallion Architecture for Accounts Payable Analytics

The Dataplatr solution implements a medallion data architecture to structure accounts payable analytics data through progressive refinement layers, ensuring data quality and analytical readiness.

- Bronze Layer (Raw AP Data Ingestion): The foundation of accounts payable analytics begins with comprehensive data extraction from source systems. Invoice data, including headers and line items, flows from Oracle EBS (AP_INVOICES_ALL, AP_INVOICE_LINES_ALL), vendor master records come from AP_SUPPLIERS and AP_SUPPLIER_SITES_ALL, and purchase order data is captured from PO_HEADERS_ALL and PO_LINES_ALL. Payment records from AP_PAYMENT_SCHEDULES_ALL and AP_CHECKS_ALL, plus receipt data from RCV_TRANSACTIONS, complete the raw data foundation for AP analytics.

- Silver Layer (Cleansed & Standardized AP Data): The Silver layer transforms raw data into standardized formats that enable reliable accounts payable analytics across the enterprise. Unified invoice repositories eliminate duplicates while standardizing tax, date, and GL coding formats, and vendor master data undergoes cleansing with duplicate elimination and banking validation. Standardized chart of accounts, normalized payment transactions with cross-ledger and cross-currency harmonization, and categorized exceptions with automated workflow tracking ensure data consistency for accurate AP analytics.

- Gold Layer (Business-Ready AP Analytics): The Gold layer delivers actionable accounts payable analytics through business-ready metrics and dashboards. Cash flow projections provide forward-looking payment obligations, vendor performance scorecards assess suppliers across multiple dimensions, including on-time payments and discount capture, and compliance dashboards offer audit-ready reports with invoice lifecycle traceability. Executive KPI views display critical AP analytics, including Days Payable Outstanding (DPO), discount utilization, exception aging, and cycle time for strategic CFO reporting.

Conclusion

Accounts payable analytics has evolved from a nice-to-have capability into a strategic necessity for modern finance organizations. The ability to transform raw AP data into actionable insights directly impacts your bottom line through cost reduction, improved cash flow management, and stronger vendor relationships.

The Dataplatr Accounts Payable Analytics Accelerator removes the complexity and time investment traditionally required to build an enterprise-grade analytics infrastructure. By leveraging medallion data architecture and pre-built analytical frameworks, finance teams can achieve comprehensive visibility into their AP operations within weeks, transforming operational challenges into opportunities for strategic value creation.