PII and PCI Compliance With Automated Data Masking

In today’s data-driven landscape, safeguarding sensitive information - such as Personally Identifiable Information (PII) and Payment Card Industry (PCI) data has become a critical compliance PII and PCI compliance across modern enterprises. Mishandling such data violates regulatory mandates like GDPR, CCPA, or PCI-DSS and also leads to financial penalties, reputational damage, and loss of customer trust.

This document presents a scalable and secure approach to sensitive data handling by implementing real-time detection and masking of PII/PCI data at the point of ingestion. tightly aligned with PII and PCI compliance strategies. By embedding automated controls within data pipelines using Python-based logic and cloud-native architectures, organizations can ensure sensitive fields are systematically identified, masked, and governed before downstream persistence.

This proactive approach enables teams to maintain PII and PCI compliance while allowing safe and controlled access to business-critical datasets for analytics, reporting, and operational use - without exposing confidential or regulated information.

Why It Matters: PII/PCI Data Risks Are Enterprise Risks

Modern enterprises routinely ingest high volumes of sensitive data including Personally Identifiable Information (PII) and Payment Card Industry (PCI) data from a wide range of digital sources such as customer portals, transactional systems, service tickets, and communication platforms. However, many organizations lack consistent, scalable, and enforceable mechanisms to manage this sensitive information securely under pci pii compliance standards.

Key challenges include:

- 1. Proactive identification of PII/PCI within both structured and unstructured data sources(PII detection)

- 2. Automated masking or tokenization before data lands in shared environments(data masking)

- 3. Audit-ready tracking of data access, lineage, and flow for regulatory compliance(PII masking)

- 4. Secure enablement of analytics on masked or obfuscated datasets without exposing raw sensitive values

Traditional data security approaches tend to be reactive and perimeter-focused, often failing to address internal access risks or enforce data protection within analytical environments. In the absence of centralized automation and policy-driven controls, PCI/PII handling remains fragmented, manual, and error-prone, exposing enterprises to regulatory violations, operational inefficiencies, and reputational harm that directly affect PII and PCI compliance.

Dataplatr’s PCI/PII Protection Framework

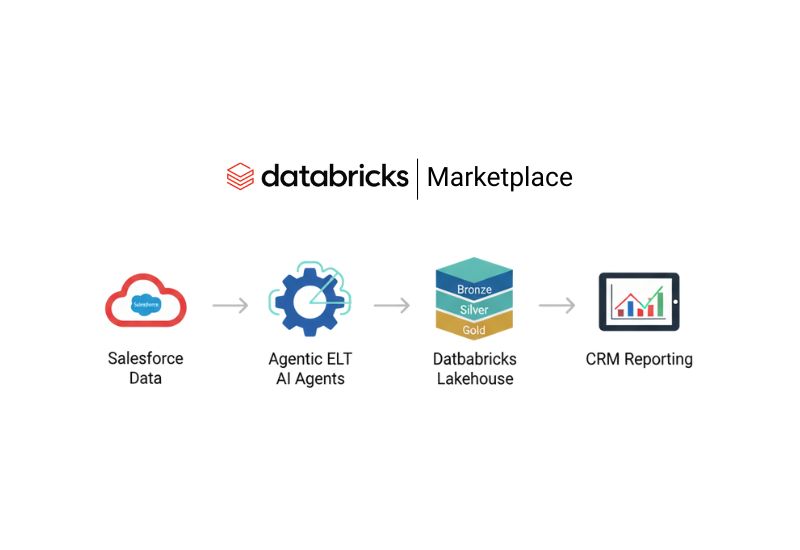

Dataplatr’s framework delivers a robust, automated, and scalable solution for securing sensitive data from initial ingestion to final storage across data lakes and warehouses. It is specifically designed to strengthen PII and PCI compliance by embedding automated governance and classification.

Whether handling customer interactions, payment records, service tickets, or onboarding forms, the framework ensures that sensitive fields are consistently detected, masked, and governed through automated, policy-driven data pipelines.

Built with cloud-native and modular architecture, this framework supports:

- 1. Real-time identification and classification of PII/PCI elements across diverse data sources (data classification)

- 2. Automated masking or tokenization of sensitive fields before they reach shared storage

- 3. Audit-ready logging and lineage tracking to support compliance with GDPR, CCPA, PCI-DSS, and other regulatory standards

- 4. Seamless integration with existing ingestion workflows, data lakes, and analytics platforms

By operationalizing sensitive data protection at scale, Dataplatr enables organizations to maintain compliance, trust, and secure data usability, without slowing down analytics or digital operations. This significantly improves enterprise-wide PII and PCI compliance posture.

Example Scenario:

In a call center environment, customer and agent conversations are recorded for quality monitoring, compliance, and analytics. However, during these conversations, customers often share sensitive information such as their address, credit/debit card numbers, email addresses, or other personally identifiable information (PII). If this data is not properly handled, it could be exposed through call recordings or analytics reports, creating a serious data privacy and security risk tied to PCI data exposure.

To mitigate this, the Dataplatr framework includes a customer care analytics solution that automatically detects and redacts sensitive information from transcriptions. It replaces sensitive fields with masked values (e.g., showing “XXXX-XXXX-1234” instead of a full card number). This ensures that any downstream reports or dashboards provide useful business insights, like call volume trends, resolution times, or agent performance- without exposing private customer information or impacting PII and PCI compliance.

This approach not only strengthens data security and compliance with regulations (such as GDPR, HIPAA, PCI-DSS) but also builds customer trust by ensuring their personal data is safeguarded in alignment with strict PCI-PII compliance protocols.

Core Framework: 3-Step PCI/PII Governance Model

Dataplatr’s sensitive data protection model ensures end-to-end governance of PCI/PII data from ingestion to secure delivery while supporting regulatory compliance, analytics readiness, and enterprise data security at scale. Key pillars of PII and PCI compliance.

Phase 1: Detection & Classification of Sensitive Information

We begin by systematically identifying PCI/PII across structured, semi-structured, and unstructured sources using a combination of rule-based logic and NLP-enhanced text intelligence.

Key Actions:

- a. Leverage regex and deterministic patterns to detect sensitive fields (e.g., credit card numbers, national IDs, email addresses, phone numbers)

- b. Apply DLP API methods to identify Scan, Identify sensitive information, and Mask the data accordingly.

- c. Classify attributes by sensitivity level to align with PII and PCI governance policies

Business Benefits:

- a. Unified visibility into sensitive data footprints across your ecosystem (data classification)

- b. Early identification of compliance exposure risks

- c. Foundational data classification layer to enforce policy-based governance and tighten PII and PCI compliance

Phase 2: Automated Masking at Ingestion

Once sensitive attributes are identified, masking or tokenization is performed automatically at the point of ingestion using scalable Python-based logic, ensuring downstream systems never store raw PII/PCI.

Key Actions:

- a. Implement field-level masking (e.g., partial or full obfuscation based on sensitivity and use case)

- b. Support dynamic masking logic driven by a configurable rulebook or policy engine

- c. Log all masking actions with metadata for auditability (data masking)

Business Benefits:

- a. No raw sensitive data in analytics or reporting environments

- b. Consistent, enforceable data protection across ingestion pipelines

- c. Audit trails for security reviews and PII and PCI compliance reporting

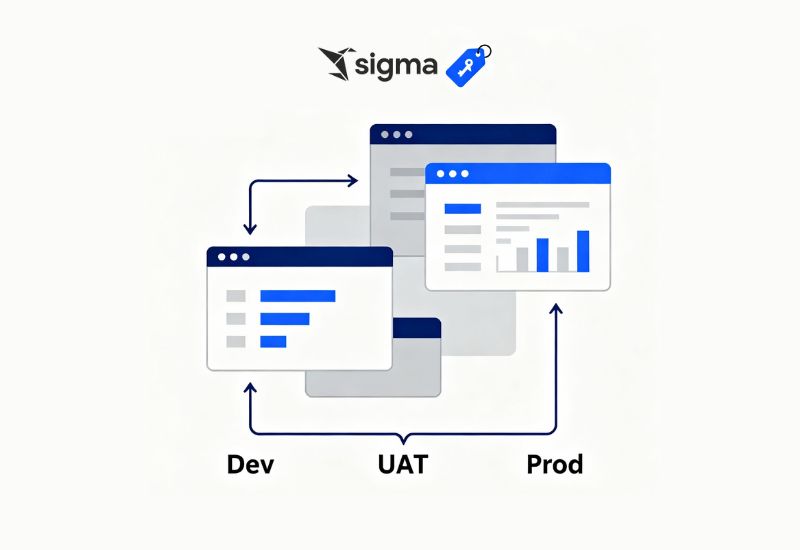

Phase 3: Secure Delivery to Data Warehouse or Lake

After masking, sanitized data is securely routed to the enterprise warehouse or data lake, preserving analytics utility without violating PII and PCI compliance requirements.

Key Actions:

- a. Load masked datasets into compliant, access-controlled platforms (e.g., BigQuery)

- b. Enforce role-based access controls (RBAC) and conditional data access based on user clearance levels

- c. Maintain lineage logs to track data transformations, access history, and policy enforcement

Business Benefits:

- a. Compliance-ready data pipelines for downstream analytics

- b. Reduced risk of internal data exposure and access violations

- c. Centralized visibility into data handling, access, and movement for auditors and security teams

Industry Use Cases: PII/PCI Governance in Action

1. Banking & FinTech Data governance identifies and masks sensitive financial data (like account and card numbers) during ingestion. Supports real-time fraud detection and analytics while aligning with PII and PCI compliance and PCI-DSS requirements.

2. Healthcare & Insurance The solution automatically masks patient identifiers and treatment records across EMRs and claims data. This is crucial for HIPAA and CMS compliance and supports data-driven initiatives like care optimization and claims analytics.

3. Retail & E-Commerce The framework protects a high volume of payment card details and PII across customer orders and loyalty programs. This minimizes data exposure risk and enables compliant data practices for personalization and marketing analysis.

4. Telecom & IT Services Sensitive customer and internal identifiers in service tickets and logs are scrubbed before ingestion into analytics or AI platforms. This achieves data privacy compliance while unlocking valuable operational insights and automation.

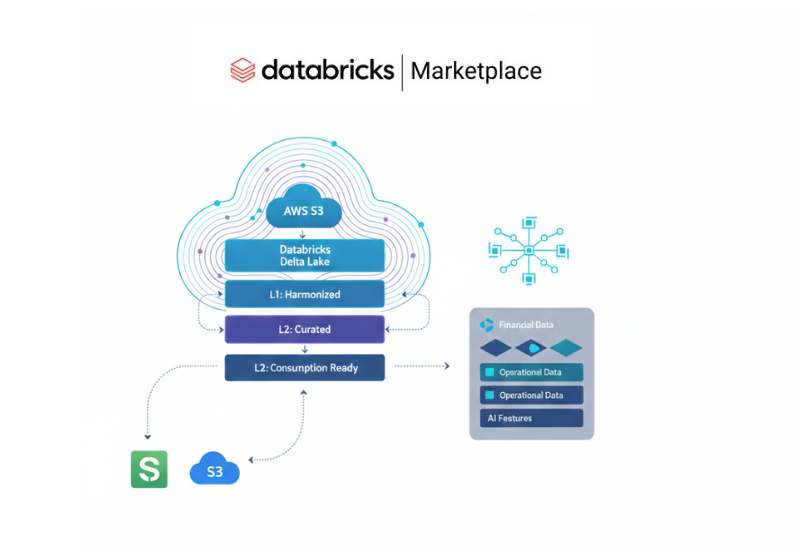

Powered by Google Cloud

Our data protection framework is engineered on Google Cloud Platform, chosen for its enterprise-grade security, scalability, and native integration with modern data ecosystems. making it a strong foundation for PII and PCI compliance workloads. The solution leverages Google Cloud’s robust infrastructure to deliver intelligent, automated PCI/PII governance from ingestion to secure delivery.

Key Technology Components:

- 1. BigQuery

Scalable pipelines for real-time detection, classification, and transformation of sensitive data, enabling compliant analytics at scale without exposing raw PII/PCI.

- 2. Vertex AI Pipeline

Implement all the logic using regular expressions and DLP API methods to scan the data, identify the sensitive data, mask the PCI/PII information, and store the results in BigQuery.

- 3. Cloud Storage (GCS)

Secure storage of staged and processed datasets with granular access controls, ensuring sensitive data is protected across its lifecycle.

This architecture enables automated data privacy, centralized control, and audit-ready operations while supporting scalable PII and PCI compliance.

What You Gain: Measurable Business Impact

- 1. Minimised Risk Exposure

Proactively eliminate sensitive data from raw zones and unsecured environments, reducing the risk of internal misuse, breaches, and regulatory violations.

- 2. Audit-Ready Compliance (Pii and Pci)

Maintain comprehensive traceability for all data classification, masking, and access events supporting seamless audits and regulatory reporting (e.g., PCI-DSS, GDPR, HIPAA).

- 3. Strengthened Customer Trust

Reinforce brand reputation by embedding data privacy by design and demonstrating a commitment to safeguarding personally identifiable and payment-related information.

- 4. Secure, Scalable Analytics

Empower analytics and machine learning teams with compliant, de-identified datasets without compromising data utility or speed to insight.

- 5. Operational Efficiency Through Automation

Replace manual data sanitization with automated, rule-driven pipelines, reducing operational overhead and enabling faster data availability for business use.

Final Word: Data Privacy Is a Strategic Imperative

Your customers entrust you with their most sensitive information. Protecting that data is central to PII and PCI compliance success. At Dataplatr, we enable organizations to modernize their data ecosystems with intelligent masking, rule-based governance, and end-to-end auditability that reinforces trust and compliance.

At Dataplatr, we enable organizations to modernize their data ecosystems by embedding intelligent masking, rule-based governance, and end-to-end auditability into every pipeline. This ensures that sensitive information remains secure, compliant, and fully usable for strategic analytics - without compromise.

Data privacy isn't just about compliance - it's about earning and sustaining trust in every interaction.

Ready to Secure Your Data Pipelines?

Let us help you deploy end-to-end PII/PCI protection, automated, scalable, and compliant from day one.

👉 Book a demo | Contact our team | Explore more success stories