Predictive analytics empowers organizations to forecast future trends and make smarter business decisions using data-driven insights. By analyzing historical and current data, companies can anticipate outcomes, optimize operations, and stay ahead in competitive markets.

What Is Predictive Analytics?

Predictive analytics is a branch of advanced analytics that uses historical data, statistical modeling, and machine learning to forecast future outcomes and trends. By identifying patterns in data, organizations can anticipate customer behavior, market shifts, and operational risks, making more informed decisions for growth and efficiency.

How Does Predictive Analytics Work?

It works by analyzing datasets and identifying patterns that can forecast future behavior.

It combines four essential components:

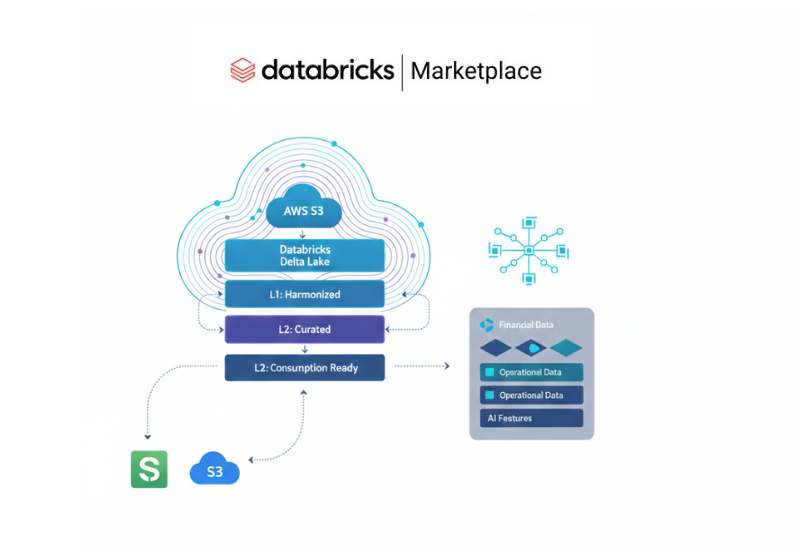

- 1. Data Collection - Enterprises collect both structured and unstructured data from CRM and ERP systems, sensors, finance applications, customer interactions, and external sources. This multi-source data foundation helps organizations capture a complete picture of operations and customer behavior. Strong data collection ensures predictive models have the necessary volume and variety to generate accurate insights.

- 2. Data Preprocessing - In this stage, raw data is cleaned, deduplicated, and standardized to eliminate errors, missing values, and inconsistencies. Data from multiple systems is integrated into a unified format to ensure consistency across the analytics pipeline. Effective preprocessing improves data quality, strengthens model accuracy, and reduces bias during prediction.

- 3. Predictive Modeling - Advanced machine learning models and statistical techniques are applied to analyze historical trends and uncover patterns. These models identify relationships and correlations that signal future outcomes such as demand spikes, customer churn, or equipment failure. The choice of model (regression, classification, time-series, etc.) depends on the business objective and data type.

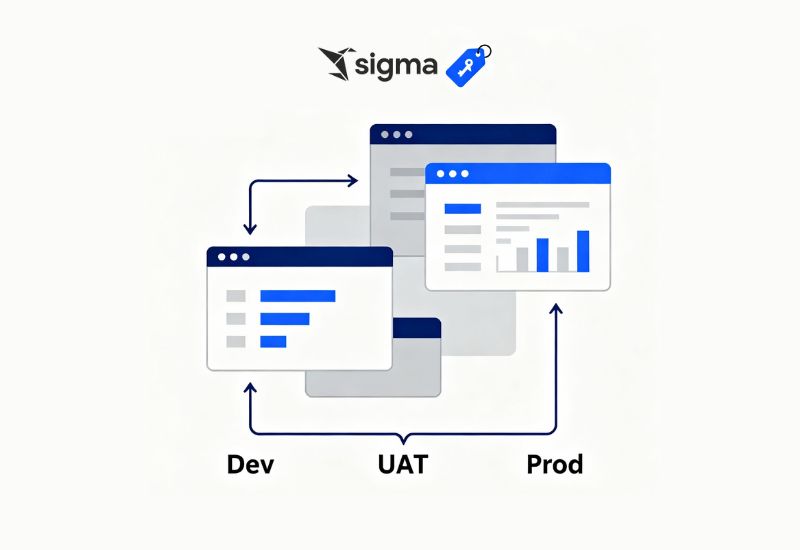

- 4. Model Deployment & Monitoring - Once validated, predictive models are deployed into business systems, dashboards, or automated workflows for real-time decision-making. Continuous monitoring helps track model performance and detect drift caused by changing market conditions or new data. Organizations regularly retrain and fine-tune models to maintain accuracy and ensure long-term reliability.

Predictive Analytics advantages and disadvantages

Advantages of Predictive Analytics

- 1. Better, faster decision-making - Predictive analytics helps leaders move from intuition-based to data-driven decisions by quantifying likely future outcomes and associated risks. This supports more confident strategic planning in areas like pricing, capacity, and investment.

- 2. Improved operational efficiency - By forecasting demand, failures, and bottlenecks, predictive models allow businesses to optimize inventory, staffing, maintenance, and resource allocation. This reduces waste, lowers costs, and improves service levels across functions such as supply chain and manufacturing.

- 3. Risk reduction and fraud detection - Organizations use predictive analytics to flag anomalies and high‑risk behaviors early, reducing exposure to fraud, credit defaults, and operational disruptions. This is especially valuable in finance, insurance, and cybersecurity.

- 4. Improve customer experience and personalization - Predictive models can identify churn risk, next-best offers, and preferred channels, enabling more relevant, timely, and personalized engagement. This often leads to higher retention, better conversion rates, and stronger customer loyalty.

- 5. Competitive advantage and innovation - Companies that effectively use predictive analytics can spot trends earlier, react faster, and design new products or services ahead of rivals. This creates a sustainable edge in crowded, fast-moving markets.

Disadvantages and Limitations of Predictive Analytics

- 1. Data quality and completeness issues - Predictive models are only as good as the data they are trained on; incomplete, inaccurate, or biased data leads to unreliable predictions and poor decisions. Significant effort is required for ongoing data cleaning, integration, and governance.

- 2. Model bias, overfitting, and degraded accuracy over time - Models can overfit historical patterns, fail to generalize to new situations, or amplify existing biases in the data. As markets, customer behavior, or regulations change, models must be regularly monitored, recalibrated, or rebuilt to stay accurate.

- 3. Inability to capture all human and external factors - Predictive analytics cannot fully account for rare events, sudden shocks, or unpredictable human behavior, such as black swan events or abrupt policy changes. Over‑reliance on models without human judgment can create a false sense of certainty.

- 4. Cost, complexity, and skills gap - Implementing predictive analytics requires investments in tools, infrastructure, and specialized talent such as data scientists and ML engineers. For many organizations, the initial setup, integration, and change management can be challenging.

- 5. Security, privacy, and ethical risks - Large-scale data collection and modeling raise concerns around data privacy, security breaches, model transparency, and ethical use of insights. Organizations must manage consent, access controls, and governance to avoid regulatory and reputational issues.

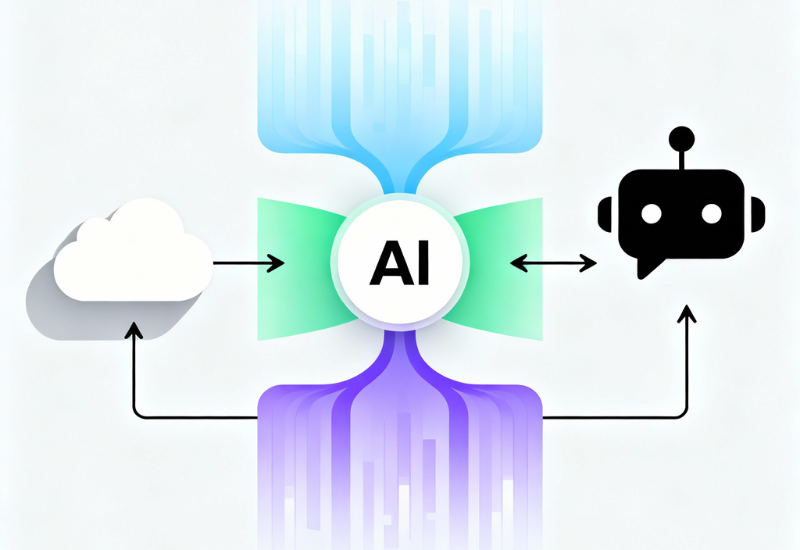

Predictive Analytics vs. Machine Learning

While predictive analytics and machine learning are closely related, they are not the same. Predictive is a broader field that uses various techniques, including machine learnin,g to forecast future outcomes. Machine learning, on the other hand, is a subset of artificial intelligence focused on developing algorithms that can learn from data and improve over time. Predictive analytics often uses machine learning models to enhance the accuracy of predictions.

What Are Some Use Cases for Predictive Analytics?

JPMorgan Chase’s Fraud Prevention System

JPMorgan Chase’s predictive analytics-based fraud prevention system is a leading example of how advanced analytics can protect financial institutions from fraud. The bank uses machine learning algorithms and Data Analytics to monitor transactions in real time, identifying suspicious patterns and predicting fraudulent activities before they cause losses.

The system integrates multiple data sources, including customer information, transaction records, and external threat intelligence. By using technologies like natural language processing and behavioral analysis, it flags anomalies and alerts security teams to take immediate action. This approach has reduced fraud losses by 50% over two years, saving the bank an estimated $100 million annually. It has also cut false positives by 60%, improved detection accuracy, and accelerated response times, enhancing both security and customer experience.

JPMorgan Chase’s success demonstrates the power of real-world banking, setting a benchmark for the industry in fraud prevention and customer protection.

Source - https://superagi.com/predictive-analytics-in-action-real-life-case-studies-of-businesses-that-succeeded-with-ai-powered-forecasting/

Predictive Analytics Examples

- 1. Predictive Maintenance in Manufacturing - Using sensor and machine data, manufacturers anticipate when equipment might fail, then intervene before a breakdown occurs, reducing downtime and maintenance costs. This proactive approach enhances production continuity, improves equipment lifespan, and ensures safer, more efficient operations.

- 2. Fraud Detection in Banking - Financial institutions apply to monitor transaction patterns and detect anomalies that may indicate fraud. The system assigns risk scores in real-time, flagging suspicious transactions for review before they result in losses. This reduces financial fraud, enhances security, and helps maintain customer trust.

- 3. Personalized Marketing in Retail - Retailers use predictive models to analyze browsing behavior, purchase history, and customer demographics, enabling them to deliver personalized product recommendations and offers. This personalization improves customer engagement, increases conversion rates, and fosters higher lifetime value per customer.

- 4. Healthcare Risk Prediction - Healthcare providers to identify patients at risk of complications, readmissions, or chronic diseases, enabling early interventions, preventive care, and better outcomes. Such capabilities help optimize resource allocation, reduce hospital stays, and lower healthcare costs while improving patient satisfaction and care quality.

Steps in the Predictive Analytics Process

- 1. Define Business Objectives - Begin by clearly defining what you want to achieve e.g. reduce customer churn, forecast demand, detect fraud, or improve maintenance scheduling. Having precise business goals ensures that this initiative aligns with strategic priorities and delivers measurable ROI.

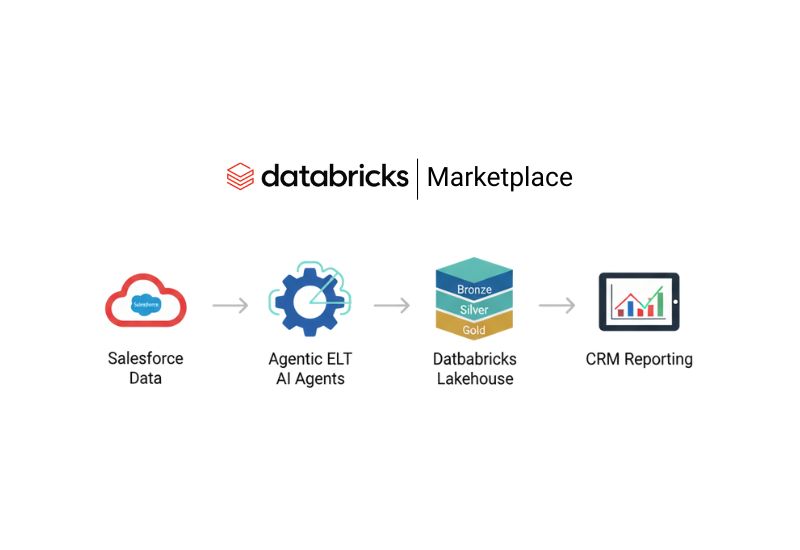

- 2. Data Exploration & Preparation - Gather relevant data from multiple sources (CRM, operations, financial, sensor logs, etc.), then clean, consolidate, and preprocess it to ensure quality and consistency. Good data preparation improves model accuracy and reliability, preventing biases or errors from corrupt or incomplete data.

- 3. Model Development - Choose appropriate modeling techniques (regression, decision trees, time-series forecasting, classification, etc.) and build predictive models using historical data. Train models thoroughly to recognize patterns and forecast probable outcomes based on past behavior.

- 4. Model Validation - Test the model against a separate dataset or real-world data to verify its predictive accuracy and reliability before full deployment. Validation safeguards against overfitting and ensures the model will perform well under actual business conditions.

- 5. Deployment & Monitoring - Deploy the predictive model within business systems or workflows such as dashboards, alerts, and automated processes. Continuously monitor performance, retrain when required, and refine the model to account for new data or changing conditions.

Applications of Predictive Analytics across Industries

- 1. Finance - In finance, it supports loan approval decisions, credit scoring, and fraud detection, helping lenders manage risk more precisely and reduce defaults. Insurers also use it to detect fraudulent claims, assess claim risk, and streamline claims processing.

- 2. Healthcare - Healthcare organizations are used for early disease prediction, patient risk scoring, readmission forecasting, and personalized treatment planning. They also use it for resource planning, forecasting hospital admissions or equipment demand, enabling optimized allocation of staff and infrastructure.

- 3. Retail & E-commerce - Retailers use to forecast demand, manage inventory, optimize pricing and promotions, and deliver personalized marketing, boosting efficiency and customer satisfaction.

- 4. Supply Chain & Logistics - It helps forecast demand trends, anticipate supply disruptions, and optimize inventory and delivery schedules, ensuring smoother supply chain operations and lower costs.

- 5. HR & Workforce Management - Businesses use to forecast employee attrition risk, predict performance trends, and plan talent acquisition/resource allocation, enhancing workforce stability and productivity.

Conclusion

Predictive analytics is a powerful tool for enterprises seeking to anticipate future outcomes and make informed decisions. Understanding its process, modeling, and real-world applications can lead to new opportunities and drive business growth.