Overview

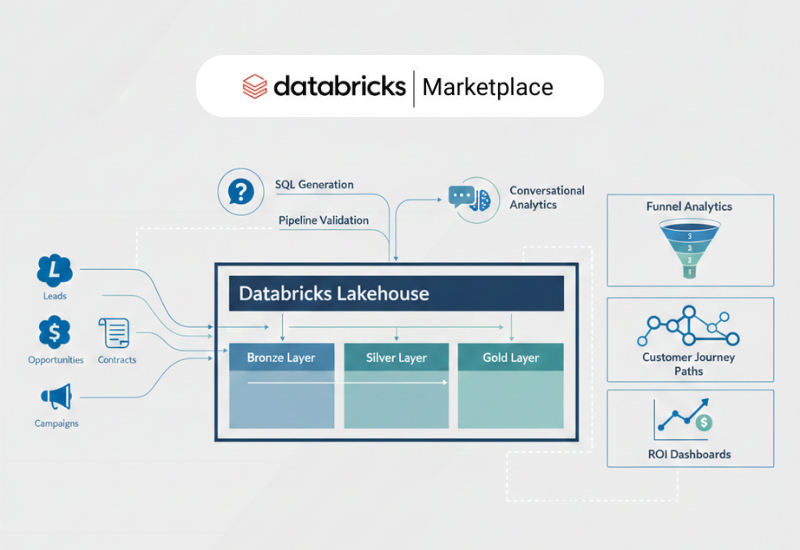

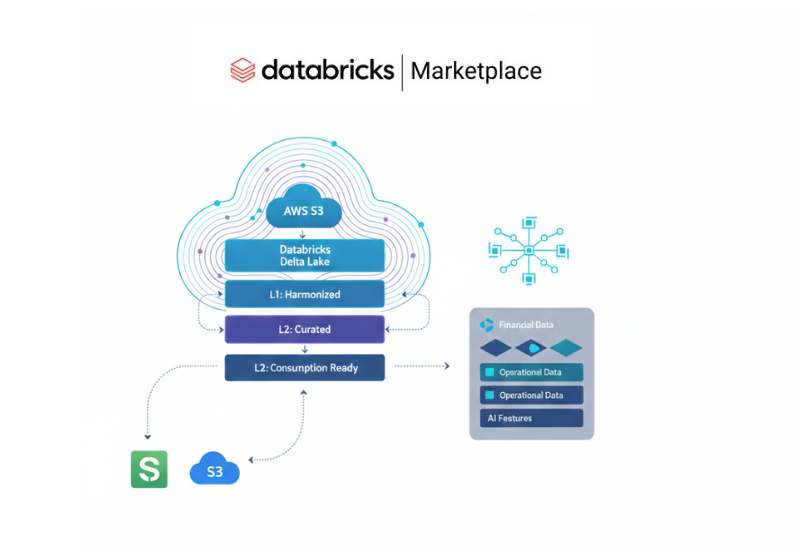

Traditional Sage Intacct reporting often requires navigating multiple raw tables, reconciling data manually, and relying heavily on IT for custom queries. Our AI Powered Sage Intacct Data Analytics solution, built on Databricks Delta Lake, changes this paradigm by delivering business-ready financial insights powered by conversational AI.

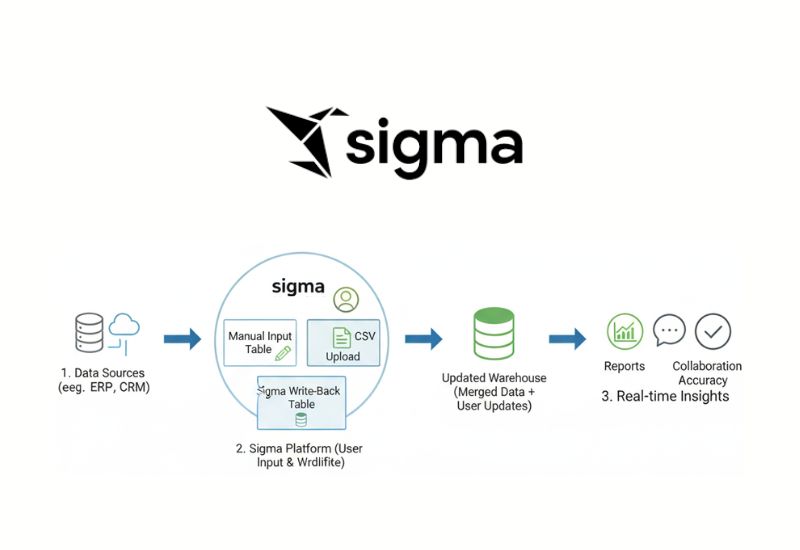

With an automated data pipeline from AWS S3 → Databricks Delta Tables (L0–L3) → Conversational Analytics, finance teams gain faster, smarter, and more intuitive insights—without the complexity of querying Sage Intacct directly.

What Makes This Platform Different?

Traditional BI tools require complex SQL queries, manual data preparation, and rigid dashboards. Our platform eliminates these bottlenecks by enabling users to:

- 1. Ask questions in plain English: “Visualize the bottom 10 projects ranked by average monthly payment?”

- 2. Connect to live data in Databricks or upload CSVs directly.

- 3. Automatically generate SQL and Python analysis code through Google Gemini AI.

- 4. Receive instant insights, KPIs, and charts tailored to the query.

The result ? Business decisions in minutes, not days.

Data Flow Diagram

- 1. Frontend (React + Chart.js) – Provides an intuitive interface where users can ask questions in plain English, upload CSV files, and instantly view AI-powered insights, KPIs, and interactive charts.

- 2. Backend (Flask API) – Handles user queries, context, and data inputs, and securely routes them to the processing engine for analysis.

- 3. Processing Engine – Prepares and interprets the data by cleaning datasets, mapping queries to the most relevant tables, and leveraging structured Gemini prompts (enriched with schema and user context) to generate:

- Optimized Databricks SQL queries (avoiding SELECT * for efficiency).

- Executable Python code for advanced data analysis.

The Role of Gemini AI: Context and Intelligent Prompting

At the core of our platform lies Gemini 1.5 Pro — not just a text generator, but an AI engine that understands business context and adapts its analysis to deliver accurate, actionable insights.

Here’s how Gemini powers our system:

1. Schema & Context Awareness

- a. Gemini is prompted with the user’s query alongside financial schema metadata and business rules.

- b. It identifies the most relevant tables and columns, ensuring the right data is always used.

- c. This prevents irrelevant joins or missed fields, keeping analysis aligned with accounting logic.

2. Context-Driven SQL Generation

- a. Gemini produces optimized Databricks SQL queries, avoiding inefficient SELECT *.

- b. Business context ensures queries return only required fields and respect financial rules (e.g., account categories, posting dates).

- c. Fabricated fields are avoided by enforcing schema-aware prompts.

3. Python Analysis & KPIs

- a. Through structured prompts, Gemini generates ready-to-run Python scripts for deeper analysis.

- b. These scripts support trend detection, KPI tracking, variance checks, and anomaly detection.

- c. Visualization logic (Matplotlib/Seaborn) is included for automated charting.

4. Intelligent Chart Recommendations

- a. Gemini evaluates both query intent and sample data to suggest the most suitable chart type (bar, line, pie, scatter, etc.).

- b. Prompting safeguards prevent mislabeling, ensuring clarity and accuracy in dashboards.

5. Natural Language Insights

- a. Beyond numbers, Gemini translates results into executive-friendly narratives:

- Key trends, anomalies, and variances.

- Business recommendations tailored to the finance domain.

- b. Context-aware prompting ensures insights are meaningful, avoiding generic AI summaries.

Business Use Cases

Using the consolidated GL_TRANSACTIONS table, finance teams can address high-value scenarios such as:

- 1. Vendor Spend Analysis (QoQ) – Track spending patterns, identify top vendors, and optimize procurement strategies.

- 2. GL Reconciliations – Automate reconciliations between entries, batches, and journals for faster and more accurate financial close.

- 3. Balance Sheet Summaries – Deliver consolidated and real-time insights for CFOs and controllers, supporting compliance and audit readiness.

Financial Importance

- Accelerated Financial Close – Automates reconciliations, reducing closing cycles.

- Cash Flow Optimization – Provides real-time visibility into vendor spend and customer payment trends.

- Cost Efficiency – Identifies opportunities for vendor negotiation and spend reduction.

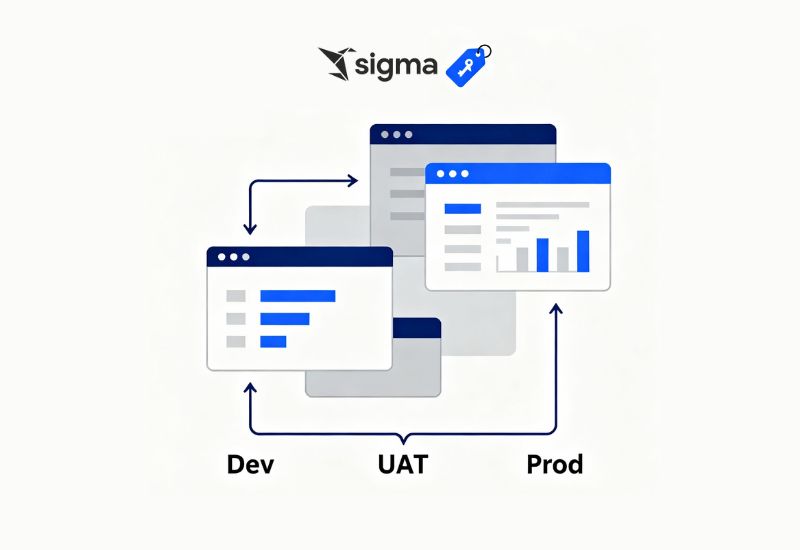

- Audit & Compliance – Built-in data lineage and governance ensure accuracy and transparency.

- Forecasting & Planning – Trend insights support proactive budgeting and scenario analysis.

- Executive Dashboards – Instant, AI-powered dashboards deliver decision-ready insights.

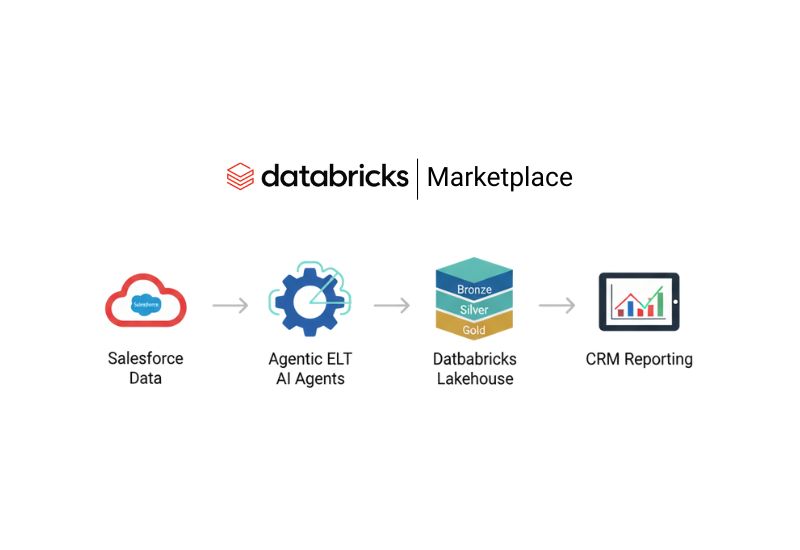

Beyond General Ledger – Cross-Module Potential

This solution is not limited to General Ledger. With the same architecture, organizations can extend AI-powered analytics to other Sage Intacct modules:

- 1. Accounts Payable – Vendor aging reports, payment scheduling, and discount optimization.

- 2. Accounts Receivable – Overdue receivables, customer payment behavior, and cash collection forecasting.

- 3. Projects – Budget vs. actual tracking, project profitability, and resource utilization.

- 4. Order Management – Sales performance, order fulfillment trends, and revenue recognition.

- 5. Inventory & Assets – Inventory turnover analysis, asset depreciation, and valuation monitoring.

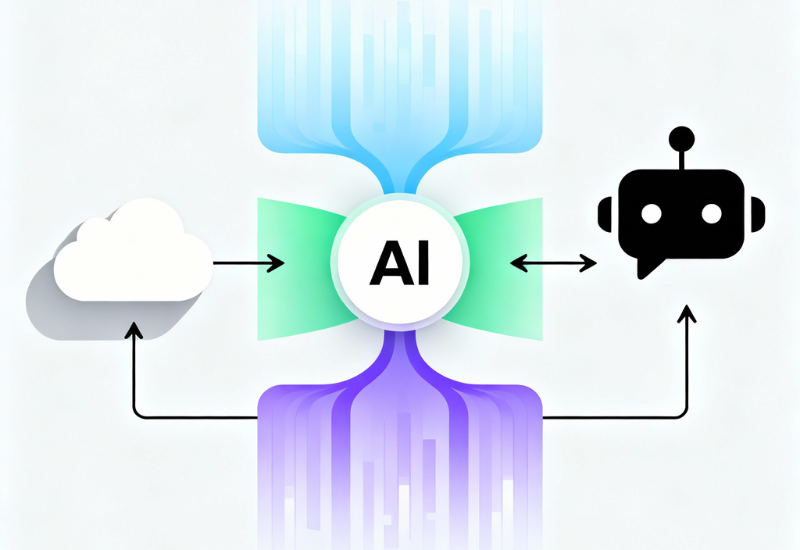

The Conversational AI Advantage

With conversational AI at the core:

- 1. Business users can ask questions in plain English (“Show me revenue trends by department last quarter”) and instantly receive results.

- 2. Outputs include beautiful visualizations that make trends easy to interpret.

- 3. This shifts teams from static, reactive reporting to proactive, insight-driven decision-making.

The Future of Sage Intacct Analytics Is AI-Driven

AI-powered financial intelligence built on Databricks enables organizations to unlock deeper, faster, and more accurate insights from Sage Intacct. With automated pipelines, schema-aware SQL, Python analytics, and conversational querying, finance teams finally get the visibility they need without the technical complexity.